Opening a bank account when you are in a jurisdiction that is not your home country is a fundamental necessity and decisive advantage. Even more, if you find yourself in any European country. This is especially true because opening a bank account in any of these countries will allow you to make commission-free transfers between other accounts belonging to the Single Euro Payments Area (SEPA). And that’s precisely the case when you open a bank account in Sweden. You will obtain these benefits and more when opening in with our local law firm.

| Quick Facts | |

|---|---|

| Mandatory bank account for companies (Yes/No) |

Yes |

| Mandatory residence requirement to open a bank account in Sweden |

For EU nationals – No |

|

Bank account opening time |

Normally between 2-4 weeks |

| Required documents – companies |

Certificate of incorporation;company's articles of incorporation, a director's declaration, and the shareholders' and directors' identity documents. |

| Required documents – individuals | Passport; residence permit; Swedish ID card; Personnummer (Swedish ID number). |

| Bank fee |

The majority of Swedish banks charge a yearly maintenance cost but do not often impose a regular ATM fee. This will be roughly 250 SEK for the majority of banks (25 USD). Although the most of Swedish banks do not have a minimum deposit requirement, it is uncommon to locate a Swedish bank account with totally no fee. |

| Initial deposit |

250 SEK (25 USD) |

| Types of accounts |

Current accounts; savings accounts; corporate accounts; merchant accounts |

| Online banking | Yes. With electronic ID card, called BankID |

|

Local agent required to open a bank account in Sweden |

No, but available on request |

| International banks present in Sweden |

Deutsche Bank, Bank of China, Danske Bank, Banco Santander, etc. |

| Requirement to travel to open a bank account in Sweden (Yes/No) | No |

|

Possibility to open a remote bank account in Sweden |

Yes, in selective banks |

| Legal representative requirement | No, but it is suggested to acquire such a service for your ease |

| Bank account creation services availability | Yes, our lawyers in Sweden can help clients open bank accounts |

Table of Contents

Recommendations from our lawyers in Sweden

Sweden is the right choice to go for those looking for a solid and free economy, with strong compliance and a well-developed banking sector.

And as in any other country, opening a Swedish bank account will be one of your first steps when arriving.

1.Commission-free transfers

When opening a bank account in Sweden, you will find that a bank account for deposits and withdrawals is called bankkonto. And it usually comes with a particular benefit mentioned before. That is that a bankkonto has an associated international bank account code (IBAN). It will allow you to make commission-free transfers between other accounts belonging to the Single Euro Payments Area (SEPA).

2. Online banking

This is something to pay attention to when you open a bank account in Sweden. That’s because not all accounts include online banking services by default. And to enjoy these services, you will need a kind of electronic identity card called BankID. This BankID gives you access to online banking services and mobile payments with Swish, the mobile payment app in Sweden. To get your BankID, you can register at any physical bank branch. And this will result pretty important. Every day Sweden is moving towards a nonmetallic payments economy. And experts are expecting to have an entire digital economy in the following years.

3. Opening and maintenance fees

We must say this is a substantial benefit when you open your bank account in Sweden. Usually, setting up a bank account in this country will cost you nothing. But with this comes that almost every Swedish banks charge a “maintenance” fee that usually goes around €20/year.

You can also rely on us if you want to buy a virtual office in Sweden.

Are you eligible to open a bank account in Sweden in 2024?

This is an excellent question to ask us as we are lawyers in Sweden. We can say that if you check the following, you can open a bank account in this country:

- Are 18 years old or more;

- Have an EU member country passport issued;

- If you are not an EU/EEA citizen, then present a Personnummer;

- Have a home address in Sweden.

Don’t worry if you are a national of a non-EU country. You can fulfill this requirement by having a residence permit.

Our attorneys in Sweden also highlight that these are essential requirements. Depending on the bank you and our lawyers decide to go for, you will be asked to fulfill some other conditions. We can also help you start your business in Sweden.

For example, most banks could ask you for a personal number. This is your Swedish personal identity number. It is obtained from the Swedish Tax Administration Agency (Skatteverket).

Others can ask for a certificate of employment or a student certificate.

Managing employee wages should always be done with the utmost care, assurance, and promptness because money is a sensitive subject. In matters of payroll management you can rely on our accountants in Sweden who are constantly informed of the most recent modifications to the regional legislation, so that you can benefit from real support.

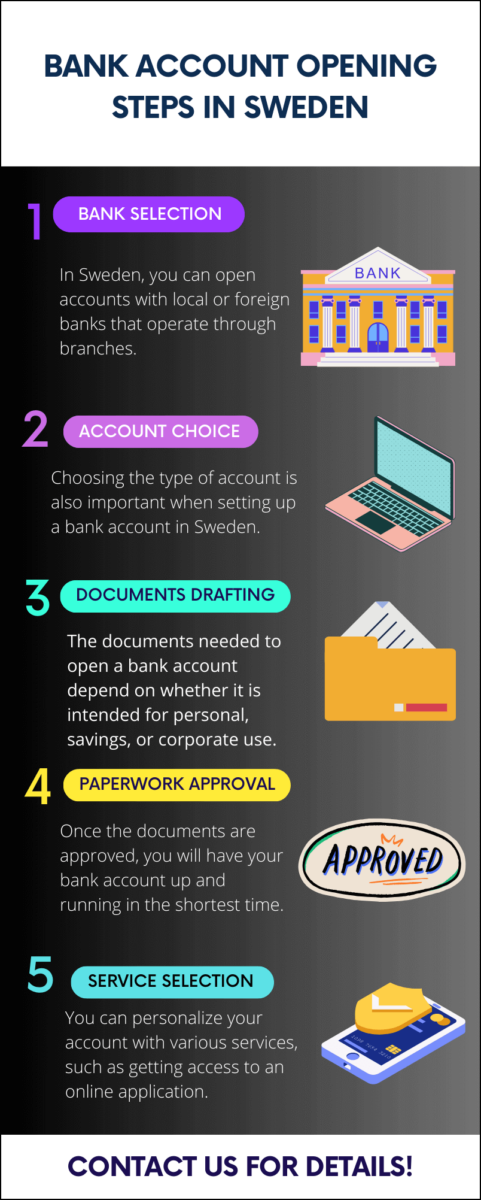

Here is also an infographic on how to open a Swedish bank account:

Types of bank accounts that can be set up in Sweden

Savings, commercial, cooperative, and foreign banks are all available in the Swedish banking system. It is worth noting that some banks may have specific requirements or restrictions for non-residents, such as minimum balance requirements or limitations on certain types of transactions. Sweden is one of the most advanced countries in Europe from an economic point of view and having a bank account here is not complicated for natural persons or companies. These can set up various types of bank accounts, from personal and checking ones to corporate accounts required for business purposes.

Foreign citizens can also open bank accounts in Sweden in 2024 provided that they have residence permits and they have turned the legal age of 18. The types of accounts that can be created are for personal use or for savings.

When it comes companies, the corporate account is used for depositing the share capital and when the company starts its activity, it can use it for the transactions it completes. E-commerce business owners must also pay attention to the fact that they will need merchant accounts for processing online payments.

Our lawyers in Sweden are at the service of foreign and local clients who need guidance in opening various types of bank accounts.

How is the procedure to open a bank account in Sweden?

Like in most countries, the quickest and easiest way to open a bank account in this jurisdiction is to go with a law firm in Sweden.

A team of lawyers like ours will take care of every little detail for you. And this will be especially helpful because, of the four major Swedish banks, only two offer online services in multiple languages. Our team can also help you in other legal matters, such as debt collection.

Fortunately, our team of lawyers will have no problem assisting you in the language you need.

So, we can help you with opening a bank account, either mobile or traditional.

With a mobile banking service, you will be able to manage all your finances from home. Moreover, it will allow you to carry out all your operations by simply downloading an app.

We will need your passport and another document that certifies your ID. And as we said. We will probably need to create you a BankID. So you can make mobile payments with Swish and enjoy other essential functions such as online document signing.

But if you decide to go with a traditional bank account, the process takes more steps. Depending on your case, we probably will be asking you to attend to a local bank branch, answer few questions and verify your identity with the bank employee. Then we will wait for the confirmation, the pin, and the necessary documents to arrive by mail.

And that’s it. You will be ready to activate your account and your online banking service if you choose to add it and our Swedish lawyers can help you do it with your company, too.

The process for a corporate bank account is relatively similar. One of the directors of the company or a representative attorney must go to the bank with the company documents, such as:

- Registration certificate

- Tax registry

- Information about the beneficial owners and directors

- Company by-laws and articles of association

After reviewing the documents, the bank will approve the bank account and send the documents via mail. Do not hesitate to reach out for support in opening a company in Sweden. We also invite you to watch our video below:

What to consider when opening a Swedish bank account as a foreigner

The number of foreign citizens is on the rise in Sweden, as the country offers economic stability and a good quality of life, which is why those who decide to move here choose to remain indefinitely.

As any other Swedish citizen, an immigrant must complete various actions among which registering with the local tax authorities and having health insurance, as well as setting up bank accounts which is a vital step for the following:

- receiving the salary or any other income;

- paying various taxes;

- purchasing goods and services;

- making transactions;

- receiving or sending money abroad.

What should be noted when opening a bank account as a foreigner in Sweden is that EU and EEA citizens can do that without too many formalities. In the case of non-EU and non-EEA citizens, however, a residence permit and tax identification number obtained with the local tax office in the city they live is required. However, these are easy to obtain, and the procedure can be supervised by our local lawyers.

It is also possible to set up the account without the tax number, however, the bank can impose certain restrictions in respect to the operations that can be completed.

It is also important to note that tax registration becomes mandatory for any foreign citizen who intends to stay in the country for more than 6 months. Since we’ve already mentioned that most foreign citizens who come here decide to remain, we recommend completing this step as soon as possible.

The following documents need to be provided when opening a personal bank account in Sweden:

- the passport and residence permit;

- the employment contract in the case of employees;

- the ID issued by the Swedish authorities;

- proof of residential address (a recent utility bill).

Depending on the chosen bank, other papers could be requested.

Our law firm in Sweden is also at the disposal of foreign investors who want to set up businesses here.

Opening a corporate bank account in Sweden

Setting up a business in Sweden implies completing various steps, among which having a bank account is essential. As a matter of fact, it is one of the first stages of creating a company in this country, as the share capital must be deposited in it and the bank statement must be a part of the business incorporation file.

Another aspect to consider about opening a company bank account in Sweden is that this is one of the lengthiest steps in the company registration procedure as it requires background checks.

Our Swedish lawyers can assist foreign investors who want to open companies and can guide them during the bank account setup process.

How to choose a Swedish bank

When opening a bank account in Sweden there are various aspects to consider, including one’s preferences. While there are several national banks, foreign financial institutions also operate through branches in some of Sweden’s largest cities, so as a foreigner, one can choose a bank that also has an establishment in his/her home country.

There are also other aspects to consider, such as the fees operated by the bank, but these are usually low. However, an even more important thing to keep in mind is the services attached to the account. Luckily, most Swedish banks rely on technology and can offer a wide range of internet-based services.

Apart from these, one can also check for additional services in the eventuality they need an overdraft or mortgage in case they decide to acquire a property in Sweden and for which they could obtain preferential interests. Do not hesitate to enquire with our lawyers for recommendations.

Some facts and figures about Sweden

The government revised its forecast for the gross domestic product (GDP) to expand by 0.6% in 2024 from 1.0%. This year’s forecasted GDP contraction was 0.5%, up from last year’s 0.8% drop. It is anticipated that employment growth will also halt and respond slowly. It is projected that in 2025, the unemployment rate will rise from 7.6% in 2023 to 8.6%. It is also anticipated that average real salaries will progressively rise in the following years. Out of the sectors to grow in 2023 was exports, which was very resilient in 2023, even climbing near the end of the year. Among them, equipment and automobile exports have increased.

In 2024, having a Swedish bank account can provide you with access to a range of financial services, including credit cards, loans, and investment accounts. Some banks may also offer special perks and benefits to customers who maintain a certain balance or use certain services. Overall, opening a bank account in Sweden as a foreigner can provide you with many benefits and make it easier to manage your finances while living in the country. Don’t wait anymore, we will become your trusted attorneys in Sweden. If you want to open a bank account in Sweden, please contact us for more information.